As we move into the fourth quarter, a complex but navigable multifamily market has emerged. Multifamily borrowers worry about the rising interest rate, the severity of a very likely recession, the approaching inflection point, and the changing business narrative following the past two years of COVID-19. However, multifamily remains a stable and attractive asset class for CRE investors.

There is a positive demand trend for multifamily rent rates nationwide. According to Reis, a leading provider of U.S. CRE data, New York is one of five states leading the nation in annual rent growth at 27.7% YOY growth. Rent growth improves the bottom line of properties along with their expected rate of return despite this high Fed Funds Rate environment. Multifamily trends in 2022 such as rent increases, the popularization of remote work, and borrowers acting ahead of further Fed Funds Rate increases is driving demand into more sub-markets of New York City.

Trends in Multifamily Financing

Context is key to navigating this market. It is critical to understand emerging trends to get the best possible financing for your multifamily properties. See here the top three trends that are expected to persist for the remainder of 2022 and into the first half of 2023:

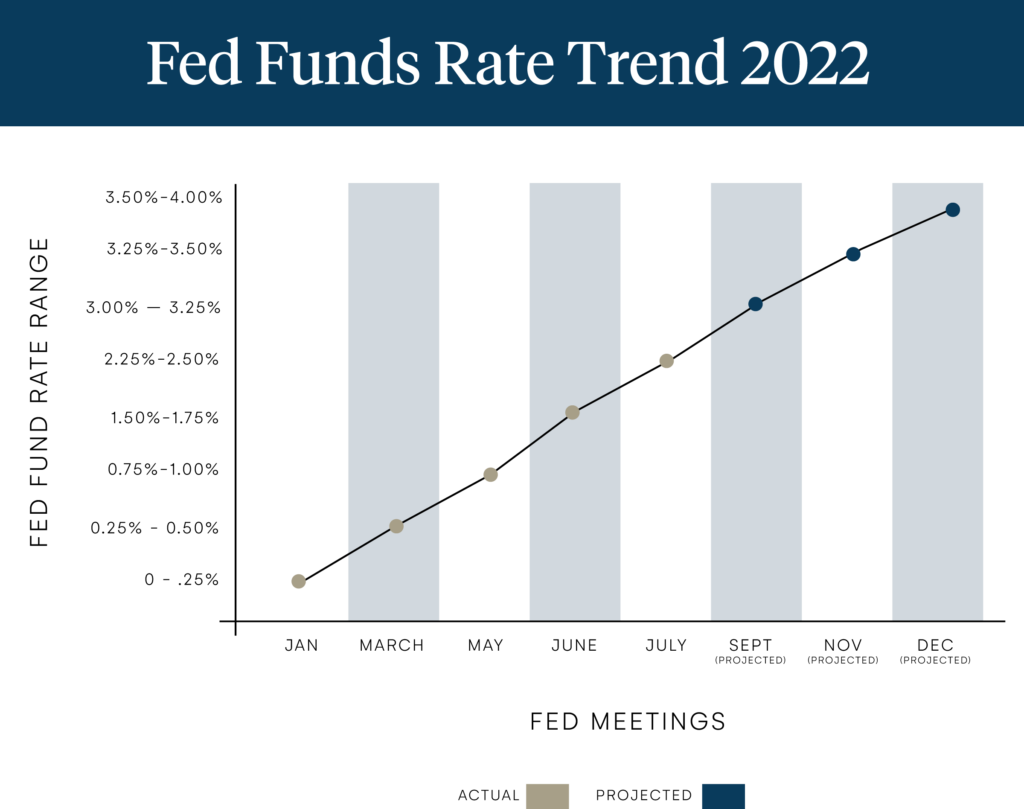

1. Continued Fed Funds Rate increases with economist forecasting that the U.S. will end 2022 between 3.5% to 4.0%* as the Fed fights persistent inflation. Such rapid increases have negatively impacted cap rate and consequently have lessened borrowers’ ability to recapture equity.

2. Recession concerns that are based on a complex variety of economic factors. The associated volatility and opaqueness have reduced the premium that buyers are willing to entertain.

3. A challenging “kick the can” strategy. Some CRE investors and owners are hoping that the market conditions will take a turn for the better in the near future. As the interest rate and cap rate continue to rise, this strategy has caused further financial difficulties and generated many missed opportunities for favorable borrowing terms.

The Fed has raised interest rates four times this year, with the Fed Funds Rate now set in a range between 2.25% to 2.50%. Despite the hike, in a historical sense the Fed Funds Rate is still maintained at a relatively low level. One of the most telling historical examples is the Volcker Shock of the 1980s. With annual inflation rates in the 80s reaching greater than 10%, the Fed Funds rate was raised as high as 20% for a long period to tame the inflation. Today, we find ourselves in a similar market condition where the Fed is likely to continue pushing for a high Fed Funds Rate to combat persistent inflation and minimize the greater economic crisis.

Many are concerned with a possible deep recession. Consumer market confidence has greatly gone down in the Fed to avoid such a recession, as the price of essential daily goods continues to experience price hikes. If current trends follow the Volcker Shock approach, multifamily borrowers must understand that often it gets worse before it gets better. Multifamily borrowers should anticipate further deterioration during the next 12 months while the Fed is very likely to continue monetary tightening to rein in inflation. However, this environment where financing cost continues to increase could be even longer and could last between 12 – 18 months.

How should borrowers navigate this fast-changing market? We see some borrowers acting indecisively and waiting to see if market conditions improve. This “kick the can” strategy can generate additional financial challenges for CRE investors and owners– as rising rates will not abate in the near future. It is unlikely for central banks in the U.S. and across the globe to let rates drop in the next 12 – 18 months. Consequently, waiting is not a prudent strategy for those facing imminent refinancing. Many banks and nonbanks are actively pursuing multifamily financing due to the stability of the asset and its straight-forward credit underwriting. As a multifamily borrower, consider securing financing with a bank partner that can be flexible and creative. Financing multifamily properties ahead of further Fed Funds Rate increases is a better financial approach than “kicking the can.”

What should you be looking for as a borrower?

According to Emerging Trends in Real Estate 2022 Survey, 89% of respondents are confident in making long-term strategic real estate decisions in today’s environment. Contextual credit structure is as important as ever and borrowers look to bank partners to understand the big picture. Rates are important but should not be the primary driving factor for selecting a lender. With today’s market complexity and volatility, borrowers should also focus on tenor, leverage, and how a lender handles credit in a depressed economic environment. A lender who is willing to provide flexibility and collaborative solution with the borrower is critical if the economy takes a turn for the worse.

Banks are more often built with relationship banking as a driving strategy, less so transactional. With the right lender, a borrower can leverage their other assets (e.g., deposits, investable assets) to negotiate more favorable terms. This is particularly true for a multifamily borrower with a portfolio of properties and can be offered multiple opportunities by their banking partner.

Creative solutions such as bridge loans are also worth considering. Bridge loans offer a short-term financing solution, and are ideal for upgrading or renovating existing properties, stabilizing newly built buildings, and converting retail or office spaces into multifamily properties.

Our dedicated multifamily team at Piermont Bank is happy to share these Top 3 Trends in Multifamily. We have over 100 years of collective banking experience in the Greater NYC commercial real estate market. For any financing needs, Piermont can give you a high-level quote within 24 hours and we rate lock for 60 days after a term sheet is executed. We stand by our terms and never re-trade our customers.

Get Started with Piermont Today