At Piermont Bank, we offer a safe and simple solution to safeguard your money during a crisis. Our Demand Deposit Marketplace ® (DDM) program is the most flexible, multi-million dollar FDIC-insured cash management solution in the market1. By participating in the DDM ® program, you can secure expanded deposit insurance of up to $5 million2 for your funds.

The DDM® program is an ideal option for individuals, businesses, municipalities, and other non-profit organizations and can provide you potential yield3 that is competitive to other options.

Benefits of participating in the DDM program include:

- Reduce overall credit exposure, diversify deposits among several FDIC-insured banks.

- Keep fund liquidity, 100% of the funds are always available for withdrawal daily.

- Increase FDIC Insurance coverage, access millions in FDIC insurance through participating banks.

- Communicate seamlessly, benefit from high-touch services of the Piermont team and avoid the burden of dealing with numerous bank relationships.

How does the Demand Deposit Marketplace ® work?

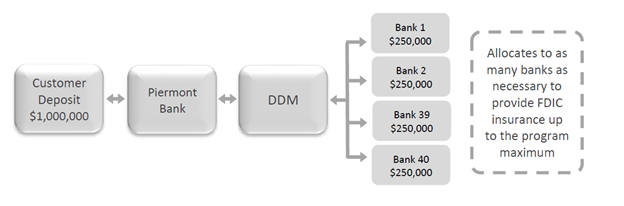

We open each applicable customer a sweep account that can sweep funds to other FDIC-insured banks. Afterwards, we allocate your funds to as many banks as necessary to provide FDIC insurance up to the maximum amount.

Rest assured that with the DDM ® program, we maintain your high levels of FDIC insurance daily, providing you peace of mind.

Want to learn more about this solution? Please fill out our Get Started form and specify DDM ® program in the request.

1This solution is through the Demand Deposit Marketplace Program, administered by Stable Custody Group II, LLC.

2If you are looking for FDIC insured limit more than $5 million, please talk to our team to see what options we may be able to offer.

3The services we provide with respect to sweep and other programs are primarily designed to provide administrative convenience for our clients to offer expanded FDIC insurance on customer funds. The services we provide are not designed to provide customers with investment enhancements, or higher rates of returns or profits on their funds.

Funds participating in the Demand Deposit MarketplaceSM program are deposited into deposit accounts at participating banks, which are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 for each category of legal ownership. The total amount of FDIC insurance in an account depends on the number of banks in the program. If the balance in the account is greater than the FDIC insurance coverage in the program, any excess funds will not be insured. Customers should read the Program Terms and Conditions carefully before depositing money into the program and for other important customer disclosures and information. To assure their FDIC coverage, customers should regularly review banks in which their funds have been deposited and notify Piermont Bank immediately if the customer does not want to allocate funds to a particular bank or banks.